一文看懂Lululemon最新财报的喜与忧→

2024-07-11

知衣科技

![]()

Lululemon向来是时尚圈、运动圈宠儿,社媒关注度居高不下,被赋予的光环数不甚数。

但这家只用十年实现了近600%的惊人涨幅、在2021-2022疫情期间压着Nike、Adidas穷追猛打,在美国创下了40.3%、28.6%营收增速的公司,为何2024年的股价形势却急转直下,一度跌幅超40%?

今天,我们就来聊一聊lululemon,用它在2018年-2023年公开的财报数据,深入挖掘这家明星企业的真实市场表现。顺便思考,lululemon的未来会就此一蹶不振,或再创辉煌?

*本文字数5000+,预计阅读时间15分钟,建议收藏~

根据lululemon于6月新公布的财报信息,2024年一季度全球净营收同比增长10%至22亿美元,净利润为3.12亿美元,净利率约为14.2%;2023财年全球净营收同比增长19%至96亿美元。

整体上看,lululemon的增长趋势仍然向好,但大众质疑的源头,是本财季的10%增长,不仅远小于去年同期的22%,也低于上一季度的13%,导致2023财年呈现出持续放缓的趋势,尤其是第一大市场北美区的疲软。

lululemon首席执行官Calvin McDonald

lululemon首席执行官Calvin McDonald对此直接表示:

“美国门店2024年以来的客流量和转化率都在下降。基于宏观经济环境的不确定性,美国消费者正在削减服装和其他非必要支出。”

美国新闻网站Quartz也在相关报道中提到类似观点,称:

“舒适、时尚可能已经不足以说服美国消费者了,他们要应对顽强的通货膨胀,省钱去购买生活必需品”。

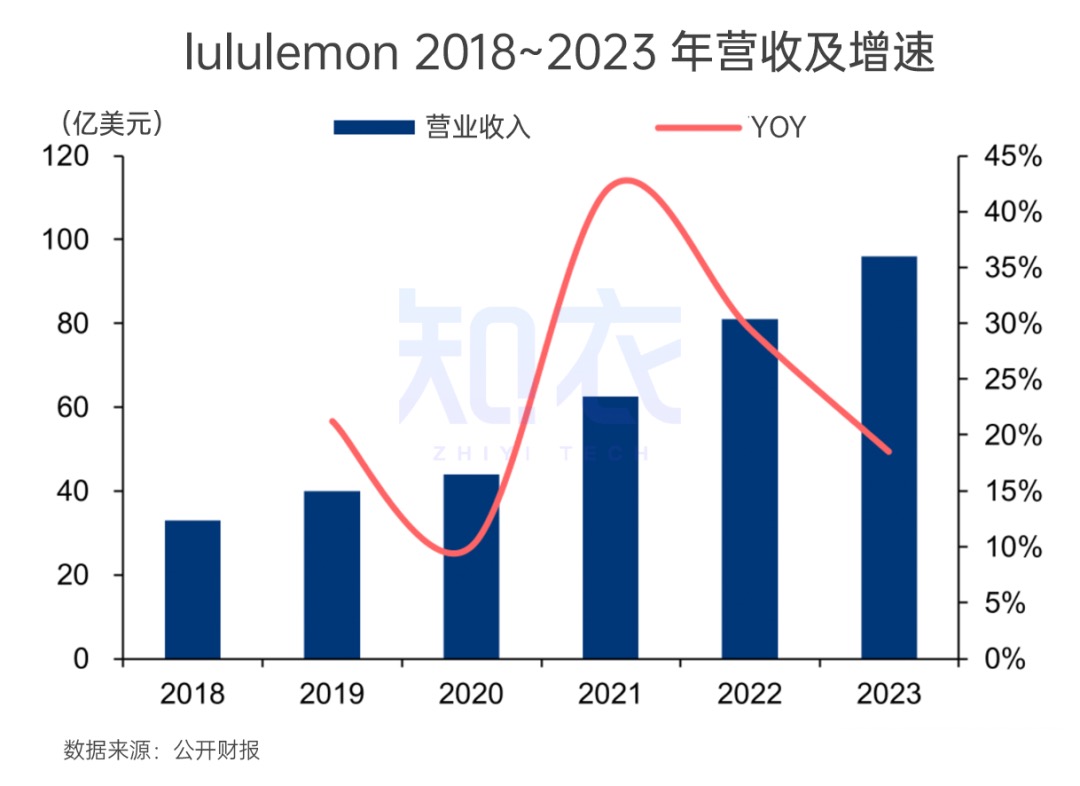

拉长时间周期看,lululemon从2018年到2023年的营收同比增长率(如下图),在2021年达到峰值42.14%后开始下降,2023年的增速不及2021年一半,仅有18.60%。

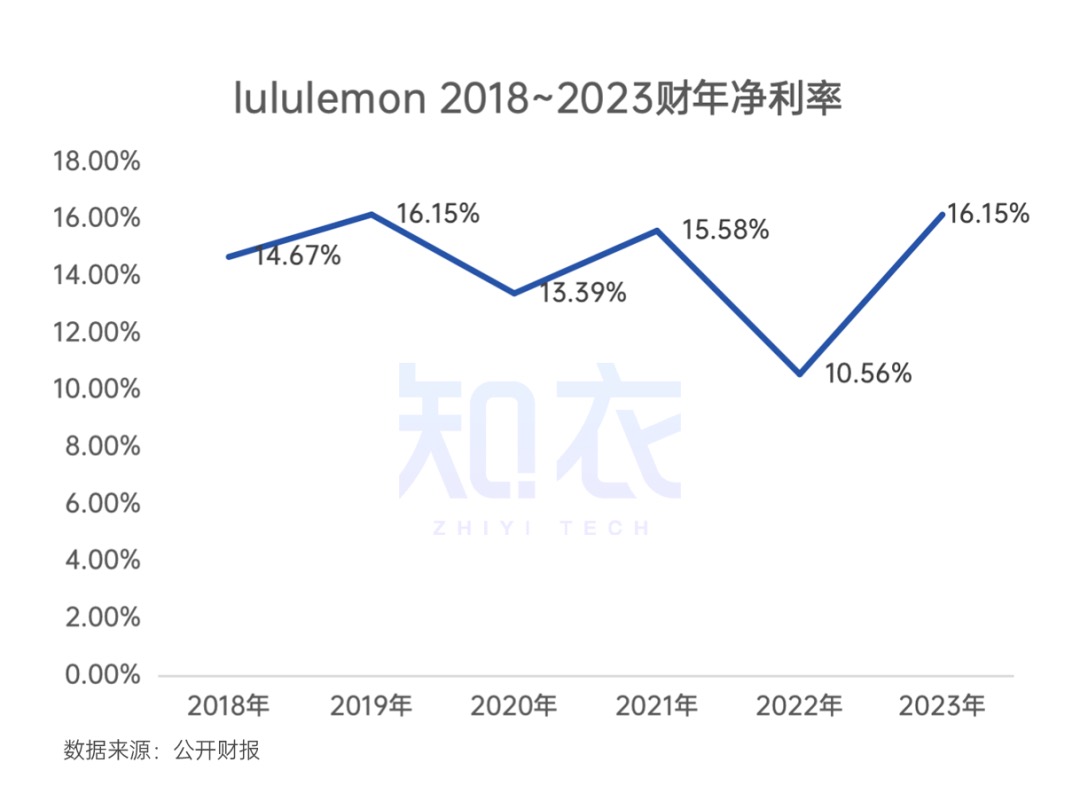

另一方面,结合财年净利率,我们注意到lululemon2018年以来的净利率基本在15%左右浮动,表现如下图:

如果将净利率以15%、10%、5%、0%作为分级标准,一般来说10%-15%属于最好一档,15%属于业绩卓越级别,lululemon有3年都实现了这一指标,其中2023年还再次达到16.15%。

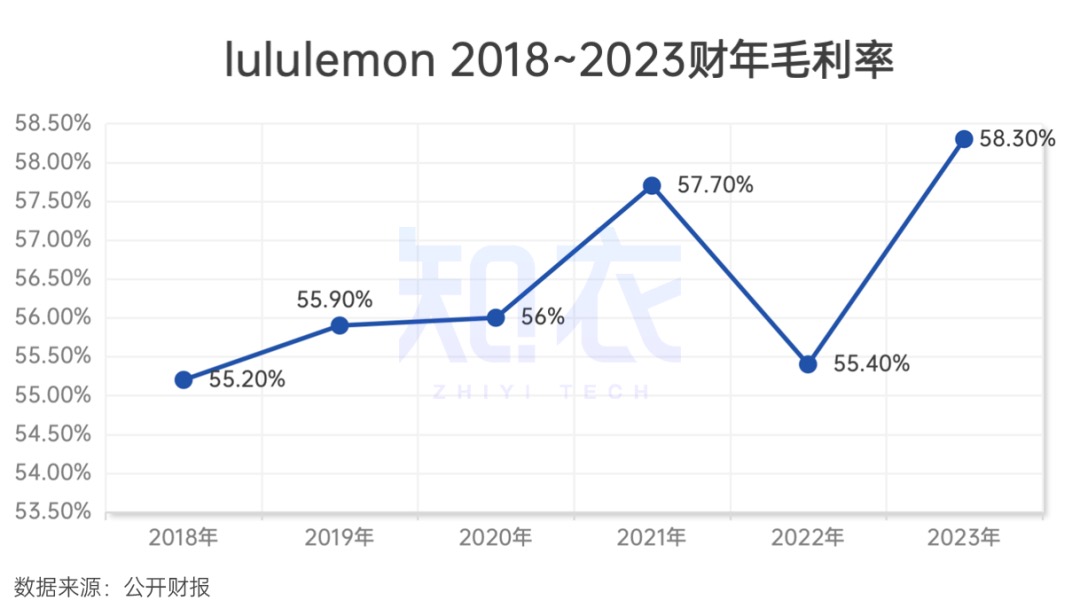

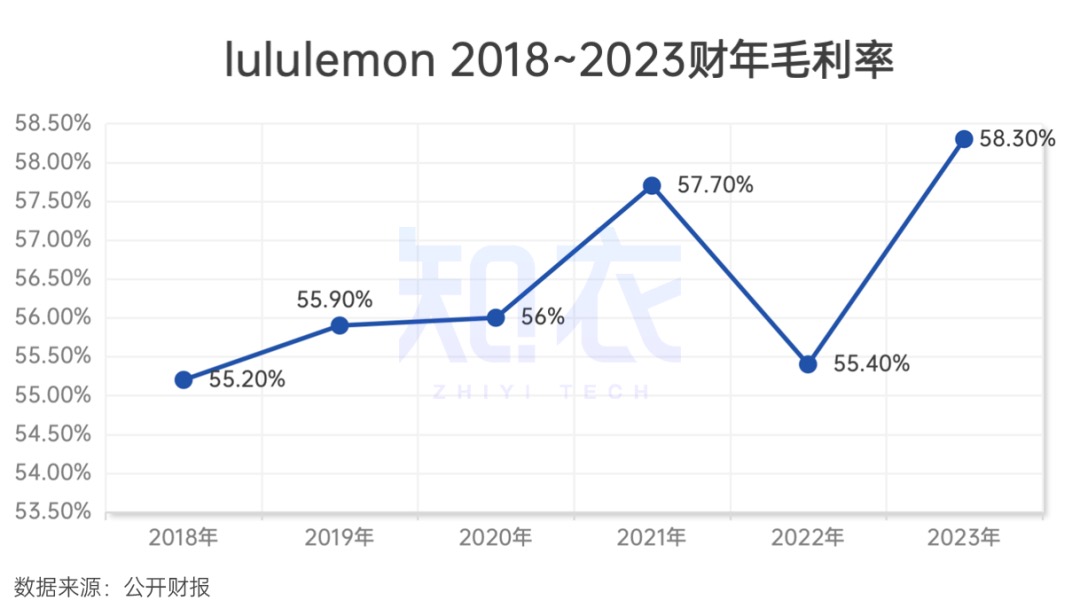

另外,lululemon历年的毛利率也基本维持在55%+的高值,2023年全年更达到了58.3%新高(如下图),说明了lululemon在2023年实际上加强了整体的盈利能力,尤其是成本控制能力。

![]()

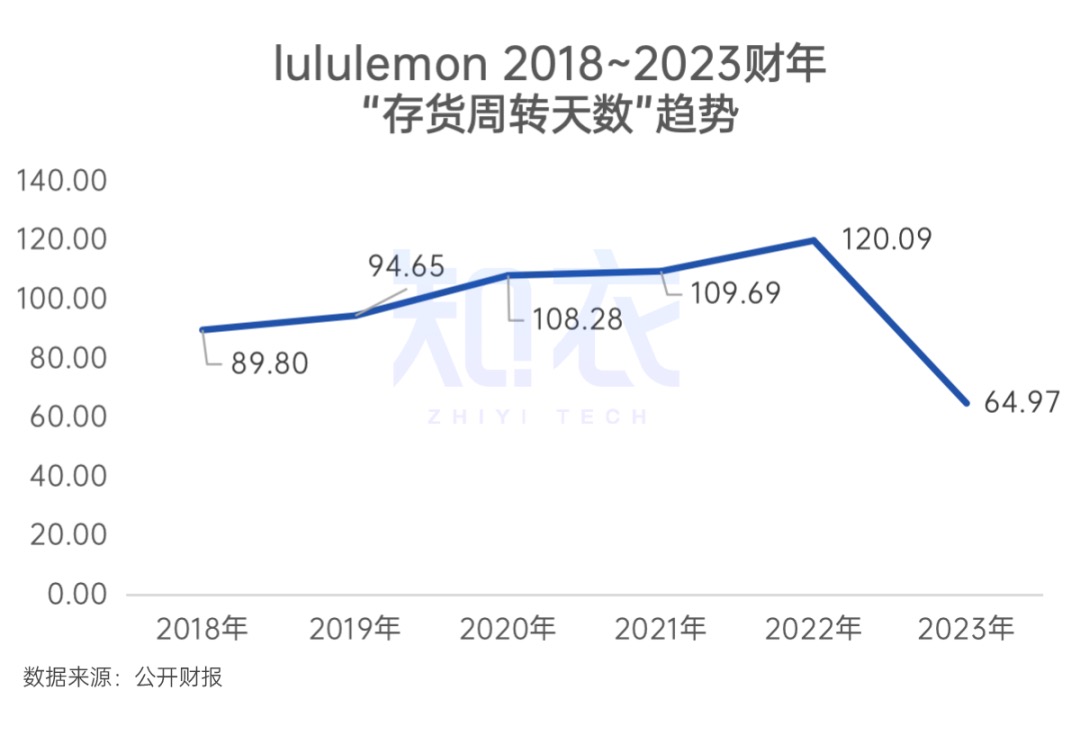

另一个在2023年显著变化的指标是“存货周转天数”,lululemon 2023年的存货周转天数从2022年的120.09猛降至2023年的64.97,说明存货变现速度加快,流动资金使用与存货管理工作效率提升,市场反应速度也随之改善。这与lululemon提高生存能力来应对不确定环境的大方向是一致的。

通过上述的净利率、毛利率、存货周转天数等数据,我们可以基本总结出lululemon的大致情况:营收增速放缓,净利率与毛利率在攀升,说明lululemon成长到一定体量后,正通过成本控制、产品结构和管理策略的优化来保证、提高盈利水平,以此面对激烈的市场竞争,并保持优势。

但财报透露出来的这些信息,还不足以长期支撑起643亿美元(最高)的市值,所以最新市值还在360亿美元波动,距离回到最高点,还需要lululemon给出真正的增长解决方案。

![]()

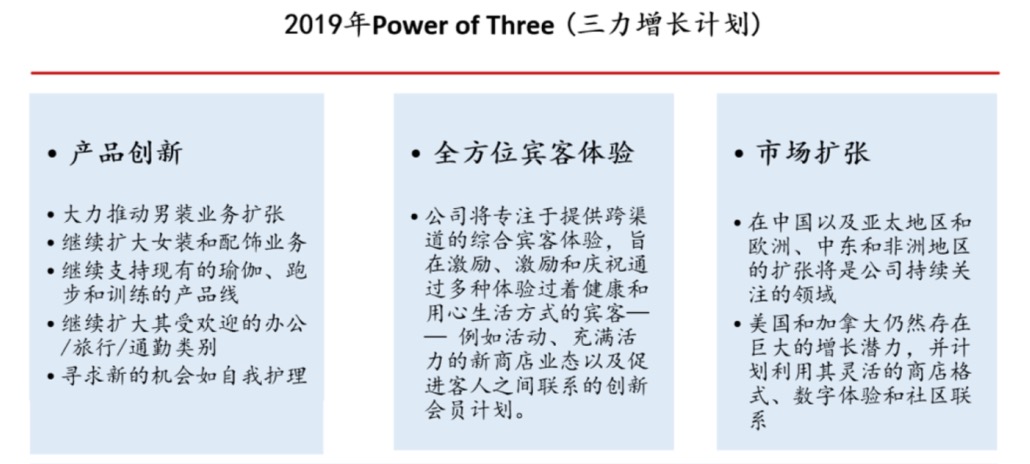

早在2019年,彼时的lululemon就提出了“五年增长计划”——Power of Three(三力增长计划),分为产品创新、全方位宾客体验与市场扩张。

这三个方向,也是lululemon近年来给出的回答,试图从中寻找到第二级增长点。

接下来,我们就来分析这个“Power of Three(三力增长计划)”,到底给来lululemon带来了怎样的成效。

增量一:中国

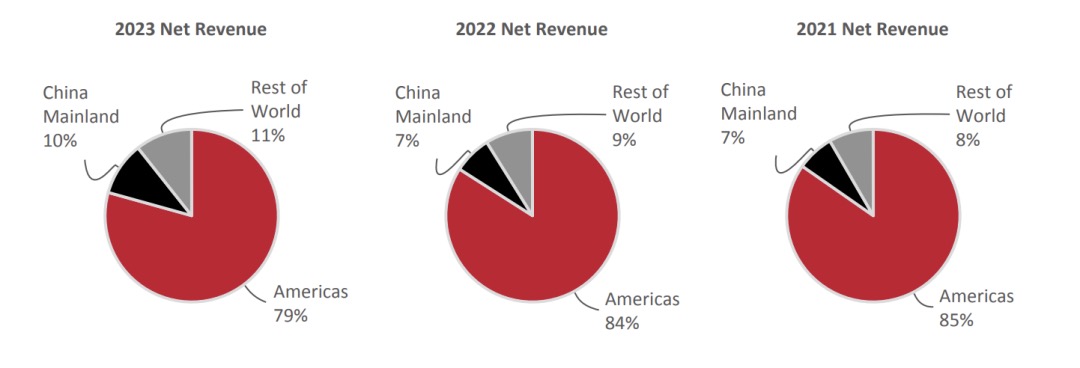

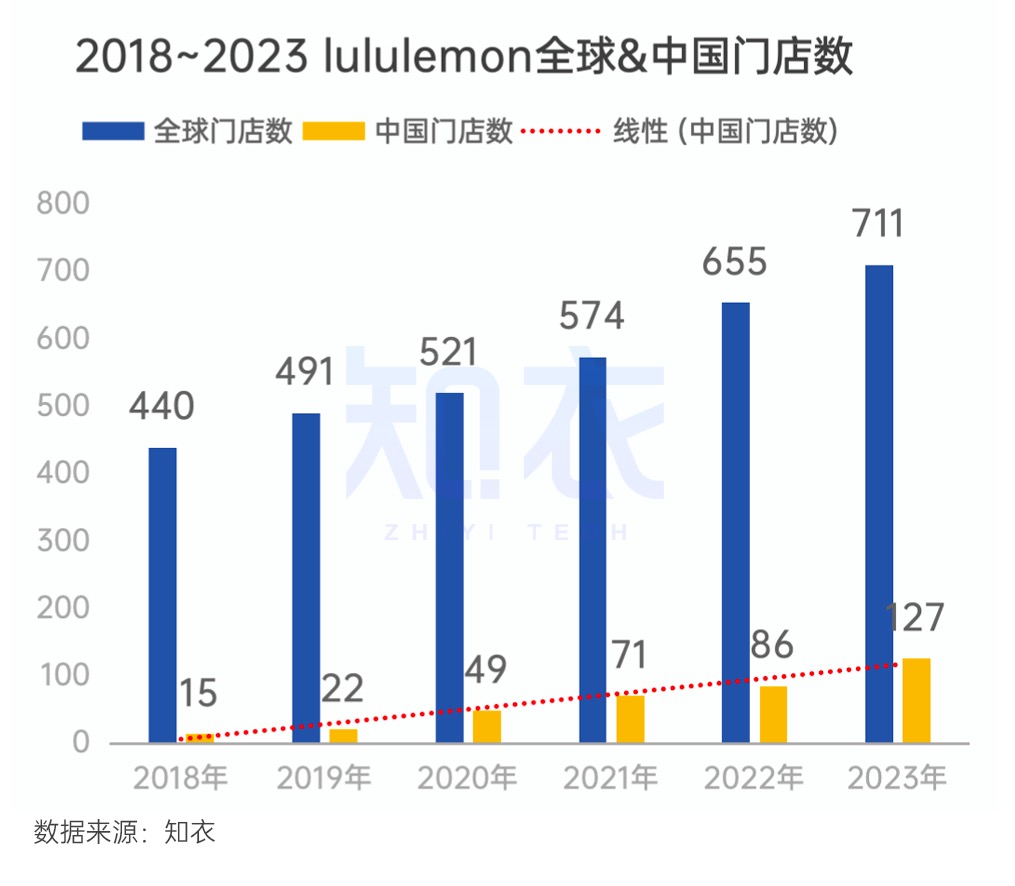

在lululemon最新公布的2023全年报中,官方着重提及了中国市场,强调了“中国的增速达到了67.2%,是2022年增速的两倍,中国贡献的营收比例也从7%的增加到了10%”,增速直接领跑全球主要市场。

lululemon 2021~2023财年营收地区占比趋势

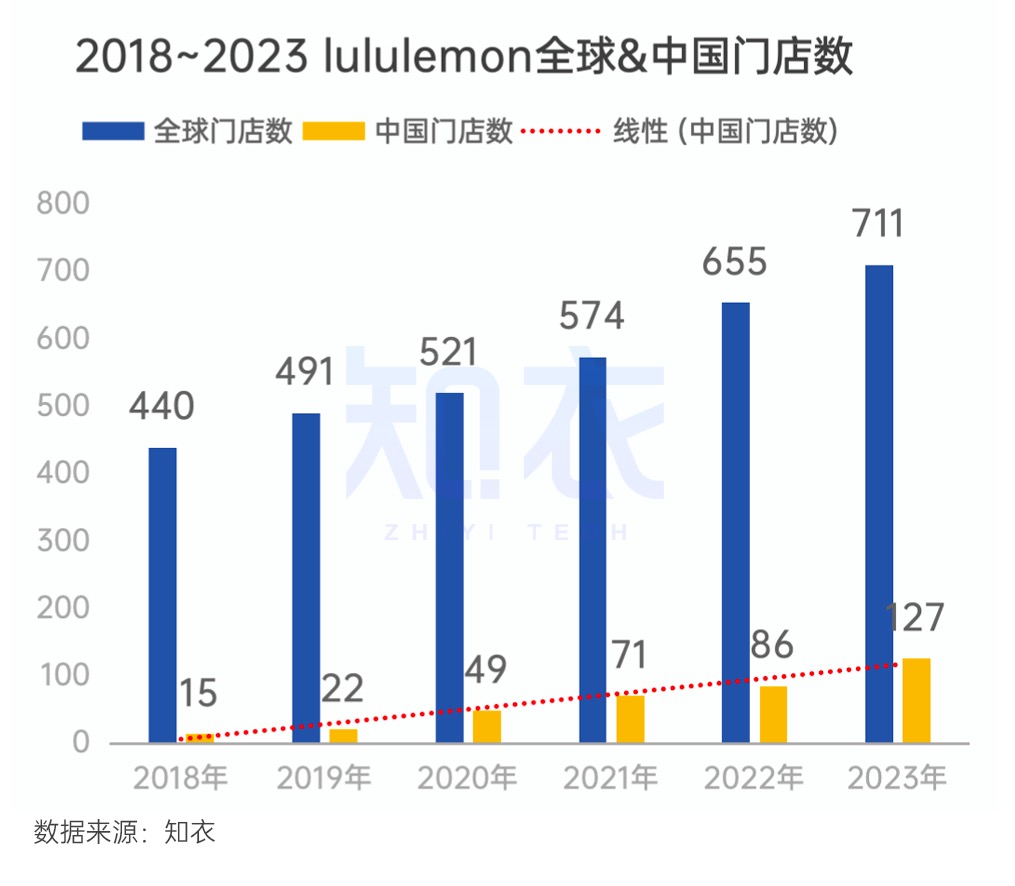

与高增长对应的是,2023年lululemon全球新增的56家门店中,中国占28家,而进入2024年后,中国门店数的增速更迅猛了(如下图)。

![]()

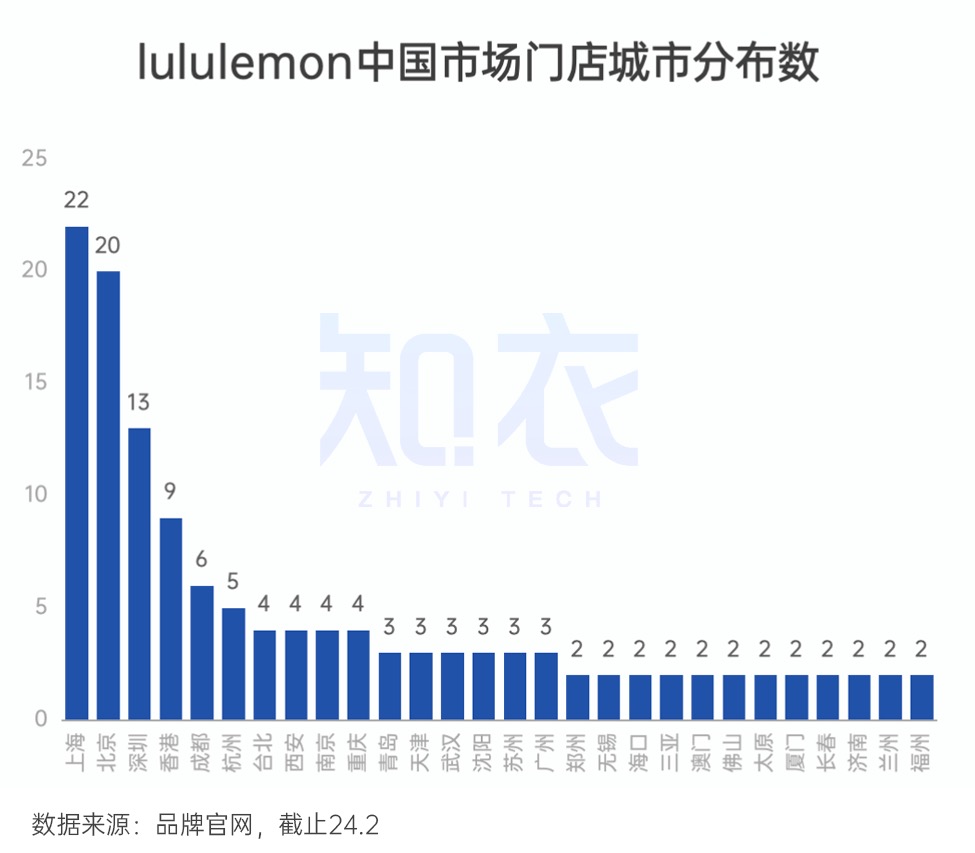

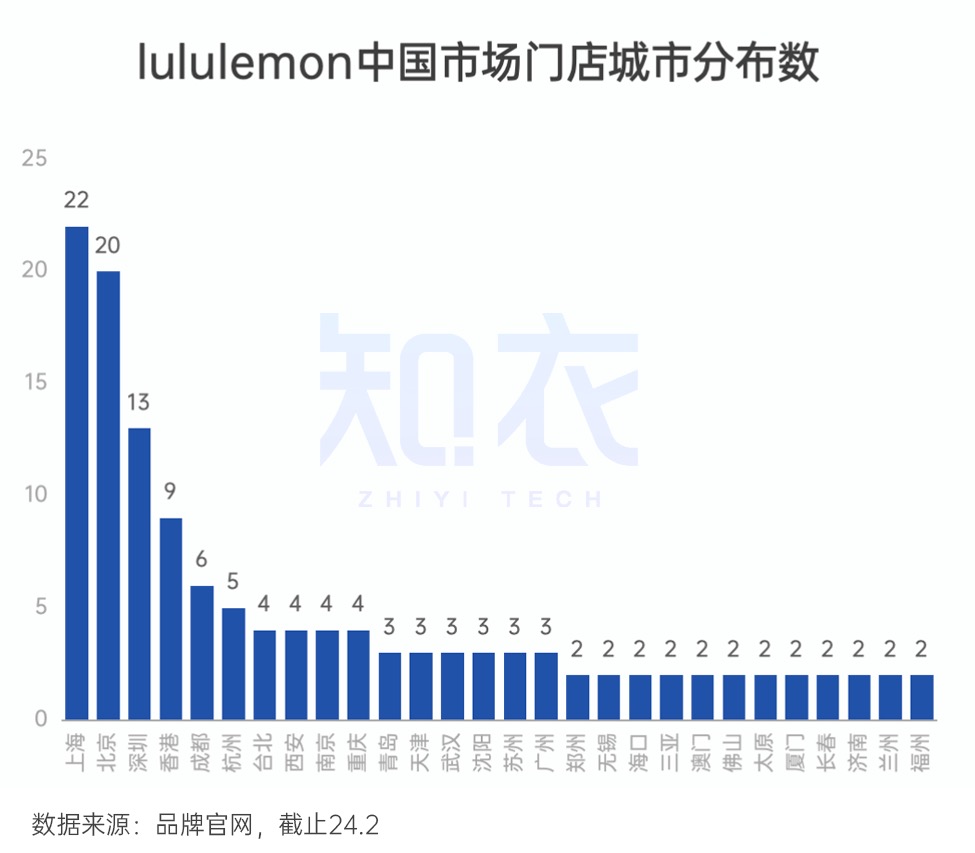

Calvin McDonald透露,将继续在中国一线至三线城市寻找机会。截至目前,lululemon在中国共有148家门店,主要分布在全国43个城市,一线城市的门店数量最多,“新一线”城市次之 ,二三线门店占比已经超过20%。

![]()

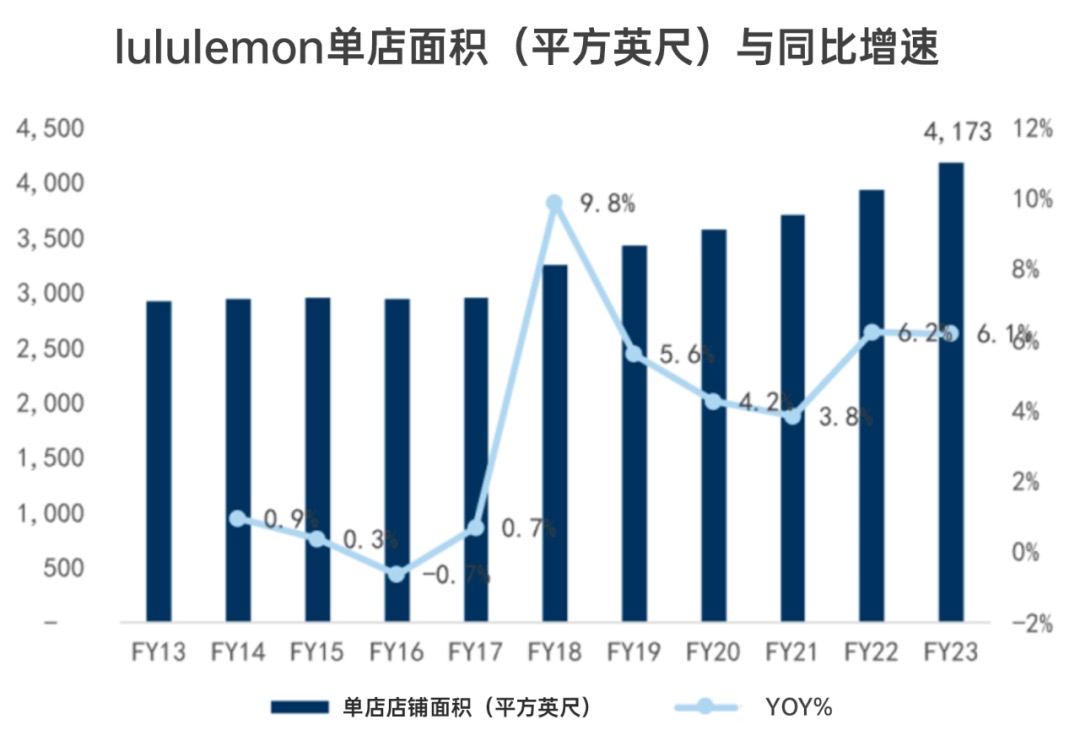

基于门店方向,还有两个非常值得关注的数据是:线下门店的店效与坪效。

截止最新的2023财年数据,lululemon中国单店平均营收超过了4400万人民币。

坪效角度,lululemon更是优秀的不像一家服装企业,有海外媒体曾报道:

“在美国零售业中,Lululemon的坪效位列第四,仅次于苹果、(墨菲)加油站和Tiffany,创下了服装零售业的最高坪效记录。”

据了解,lululemon在2019年的平均坪效是1657美元。疫情后的2023年,坪效恢复到1609美元。

一般情况下,只要坪效持续攀升,lululemon只需按计划在中国新增门店,线下门店的营收规模就会持续增加,成为一项稳定的营收来源,这也会是lululemon在2024年财报中更亮眼的增量来源。

增量二:线上渠道

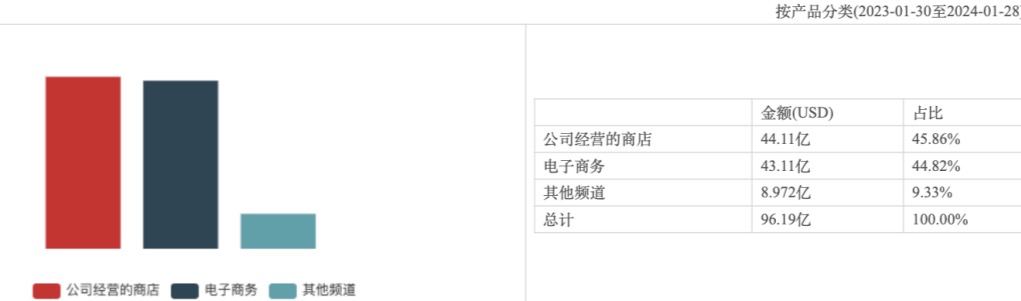

从渠道分析,lululemon的销售渠道主要有:线下直营专卖店、线上电商。

最新的2023财年报显示,lululemon线上电子商务收入占比达到了44.82%,与线下门店的45.86%,形成并驾齐驱的格局。

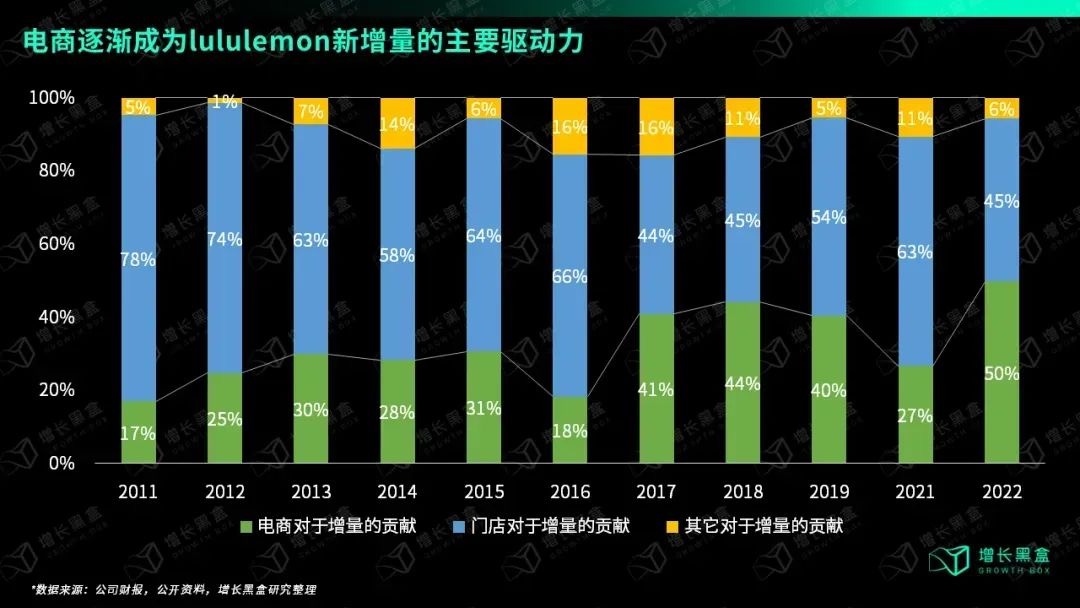

增长黑盒数据显示,电商对lululemon增量的贡献逐年递增,从2011年的17%增至2022年的50%,即lululemon每年比去年多赚到的钱中,有一半都是靠电商贡献。

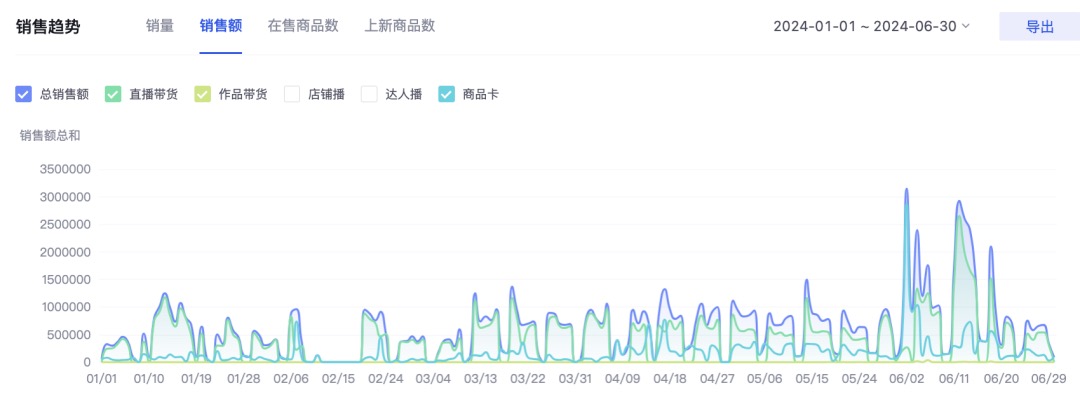

根据知衣的「抖衣」数据,lululemon今年1月刚开业的抖音官方旗舰店,在二季度运动用品行业一举跃升至品牌榜第三名,销售额更是环比上涨了244%。在运动服行业,lululemon抖音官方旗舰店的6月销售额环比5月也上涨了82.12%。

结合「抖衣」洞察的lululemon抖音官方旗舰店1-6月销售额趋势,从中可知其销售构成主要由直播带货促成,在618活动周期内达到了新高。

还有lululemon经营更久、运营更常态化的天猫旗舰店,我们可以观察到以下数据概况:

截止6月17日,lululemon天猫旗舰店的粉丝数350W+,店铺近7天的商品销量18W+,销售额8800W+,平均价格为481元,或与618期间,lululemon天猫旗舰店推出的满1299减100的折扣及各类代金券相关。

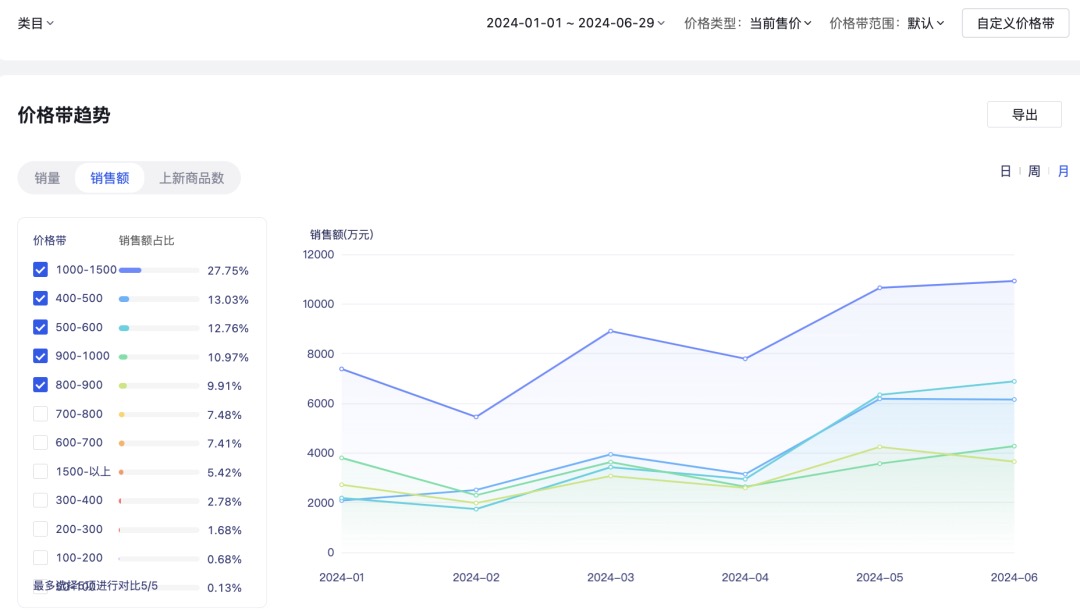

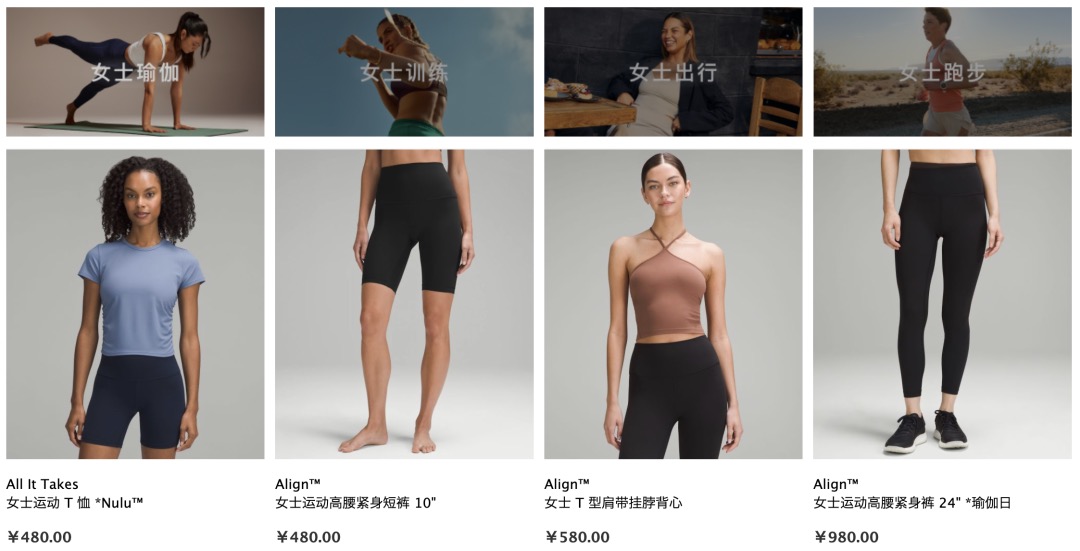

借助知衣的「价格带分析」可知,lululemon天猫旗舰店2024年至今的主力价格带为1000-1500元,占比为27.75%,这跟lululemon单价上千的王牌产品瑜伽裤价格区间一致。

销售额占比第二的价格带是400-500元,与500-600元共占比25.8%。值得注意的是,根据走势图,这两个价格带的占比均在618活动期间有所上升,体现了lululemon天猫旗舰店在此期间运营的在线折扣、满减等优惠活动。

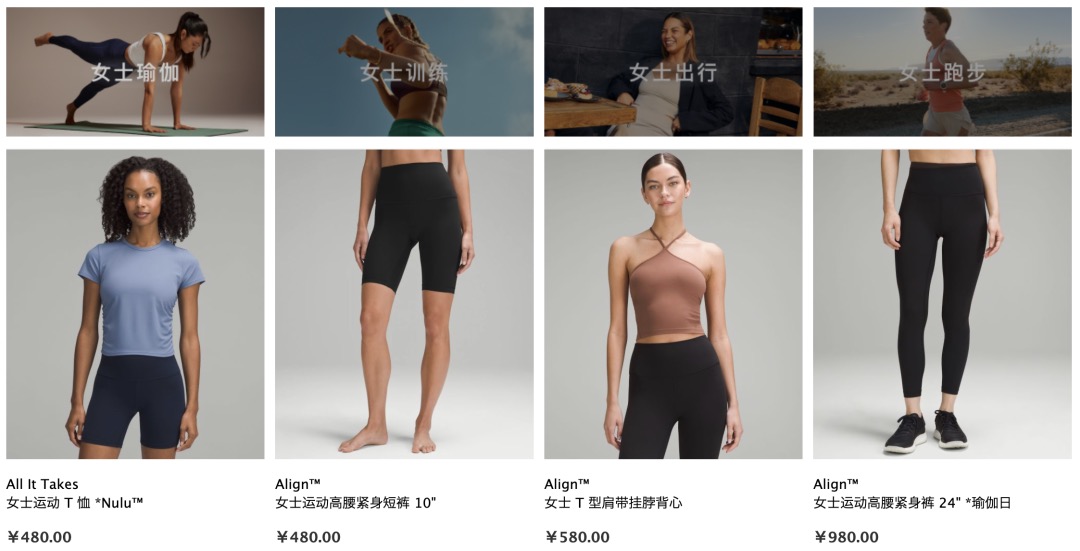

将分析的商品范围对准「运动/瑜伽/健身」行业,注意到lululemon天猫旗舰店自2024年年初以来对产品进行了价格调整,尤其是热卖款瑜伽裤,多数产品降至400元-500元的区间,其中多款特价产品的折扣率更高达5折。

![]()

显然,lululemon正通过这样的促销力度,尝试进一步打开中国瑜伽装备的消费市场,尽管这与其创始人Wilson的“初心”相违背:

“把瑜伽裤价格卖到普通产品的三倍,关键一条是不要打折”。

增量三:男装业务与配饰

实际上,lululemon在2013年就试水过男装业务,代表产品为ABC裤。有资料显示,lululemon曾分别于2014年、2016年在美国曼哈顿下城、加拿大多伦多开设过男装店,但均在短短几年后关闭。

待到2019年,lululemon发布的Power of Three(三力增长计划)中,产品创新一项着重提及“大力推冬男装业务扩张”,明确指出男装产品线是至关重要的增长点,并且要实现男装收入翻番。

三年后,lululemon的男装净收入达到15.36亿美元,为女装净收入的37%,不仅实现了翻番这一目标,还将原计划升级为“Power of Three×2”,计划在接下来的五年,让男装收入在以往基础上再次翻番,总收入目标也将翻倍增至125亿美元。

于是,我们看到了近来lululemon针对男装业务的动作频频:

-

23年11月,在上海虹桥天地开设中国内地首个男装快闪空间;

-

24年1月,在北京开设了亚太地区首家男装独立门店;

-

24年2月,lululemon宣布推出首个男士鞋履系列;

-

24年3月,首席执行官表示要在2024年推出更多男装新品;

基于此,2023财年第四季度的男装业务表现可圈可点:lululemon男装收入增幅在该财年内首次超过了女装。

Power of Three(三力增长计划)的产品创新中,还有一项是“继续扩大女装和配饰业务”,拓展更多品类,如2022年3月陆续推出四个全新品类——鞋履系列、网球系列、高尔夫系列、徒步系列等,标志着lululemon在全品类女装市场的全面布局。

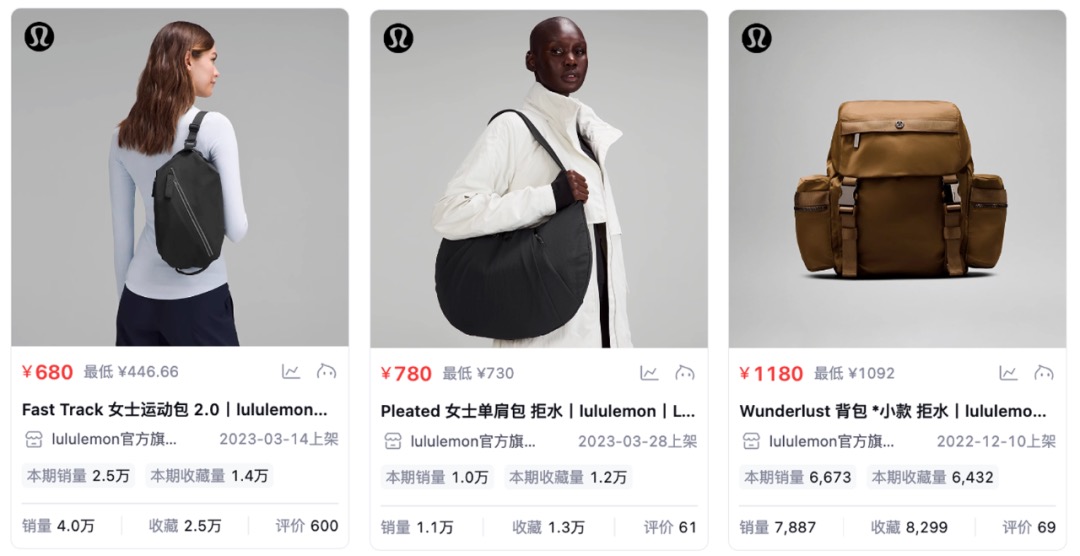

配饰方面,lululemon 则希望通过消费门槛更低的配饰类产品帮公司吸引到更多新客户、刺激老客户更多消费。Calvin McDonald 强调,全球配饰市场价值 1100 亿美元,lululemon 目前只占了不到 1%的份额。

因此,lululemon开发了 Fast Track、On My Level 和 Quilted Grid 等手袋产品。随着腋下包和大包风潮兴起,小红书上「lululemon 包」关键词笔记已超过6万条。2023年,其配饰产品线的营收占比已经到了13%,主打产品是一款诞生于2018年、售价几十美元的包包。

根据知衣数据,lululemon天猫旗舰店上的包款单品亦有不俗销量,如“Fast Track 女士运动包 2.0”,2024年销量已经超过了2.5W,单品销售额超1700W元。

数据来源:知衣

此前市场曾质疑过lululemon,主要集中在它应如何面对传统优势领域趋近于饱和的情况,是要选择坚守细分领域和核心用户?还是选择拓展价格带和品类以吸引新人群?这对lululemon无疑是一个两难。

现在看来,为了尽快寻找到下一个增长点,lululemon已经从曾经的专注女性瑜伽服饰,发展为如今的多性别、多品类,给出的回答已经很明确了。

![]()

不可否认,lululemon带火了一整个瑜伽服品类,随之也迎来了更多的市场竞争者,最典型的莫过于其他品牌的相似定位产品,以及各种“平替”。

尤其是原运动赛道的玩家,如耐克、安踏等,在看到瑜伽功能服饰畅销后纷纷跟进,具体表现为:

-

-

李宁在2021年重新整合女子运动产品线,将产品延伸到瑜伽紧身裤、运动内衣等类目;

-

安踏收购瑜伽服品牌MAIA ACTIVE,同时旗下多品牌对瑜伽产品线均有布局;

-

GAP旗下运动女装品牌Athleta推出瑜伽裤面料“Pilayo”;

-

主攻内衣的Ubras、专注防晒衣的蕉下也推出了瑜伽裤和美背等产品

lululemon对此也非常在意,还在2022财报中特别提及了与其有直接竞争关系的品牌,包括阿迪达斯、耐克、彪马(PUMA)、安德玛(Under Armour)、哥伦比亚(Columbia)等。

另一边,国内外顺势摸着lululemon过河,趁势崛起的新势力品牌也不少。比如国内被视作“Lululemon平替”的VFU、Particle Fever粒子狂热、MAIA ACTIVE 、暴走的萝莉,还有北美地区爆火的Alo Yoga、获得过软银投资的Vuori…

尤其是Alo Yoga,其核心产品瑜伽裤的定价主要在98美元至138美元区间,如明星产品高腰Goddess系列瑜伽裤定价138美元,高腰Airlift瑜伽裤定价128美元,与lululemon瑜伽裤定价直接同一价格带,如Align系列最高定价也是128美元。

此外,Alo Yoga还直接威胁到lululemon的核心客群——欧美的90后和00后,一批更年轻、拥有更多社交话语权的Z时代消费者。更有媒体戏言:

对比之下,lululemon成了妈妈们穿的品牌,更年轻的女儿们则更喜欢Alo。

截止目前,Alo在全球11个国家开设了93家门店,2023年10月底,路透社报道称,Alo母公司正以100亿美元估值寻求融资。

就像lululemon曾给耐克、阿迪的消费者带来新鲜感一样,这些后来者品牌也能比“过气网红”lululemon更能提供新鲜感。

同时,随着lululemon的面料工艺已成为公开的秘密,各大电商平台上更是出现了号称工厂同源的lululemon“平替”,如拼多多、1688上大量的“lululemon同款”、“lululemon代工厂”等标签的商品卡片,价格只有正品的十分之一,销量却数以万计。

可以想见,当这些同类竞争者争先涌现在瑜伽服、乃至整个运动服赛道,并且凭借着前人——lululemon的运营经验,及更先进的供应链成本、分销渠道、营销效率,一旦卷起竞争,lululemon要面对的形势不可谓不严峻,无论国内外。

对lululemon来说,如今这欣欣向荣的瑜伽服市场正是它“打江山”的功绩,然而艰难的“守江山”才正要开始。仅凭目前的探索,或许是不够的;喜忧参半的媒体与跌宕波动的股价,或许也是这么想的。