多年以前,美团创始人王兴曾戏言,在消费投资和市场价值领域中少女>儿童>少妇>老人>狗>男人,总结为一句话,即“男人的消费力不如狗”。

另一方面,在中国互联网市场进入存量时代的现在,流量触顶天花板后,品牌烧钱换来的获客成本逐年递增,男性消费重新被视为一个充满可能性的“掘金蓝海”。其中首当其冲的就是男装市场。

但关于男装市场的看法,业内却有着截然不同的说法:

有人说“男装业务的增长非常强劲,这是我职业生涯中见过的最强劲的增长趋势”,长期看好“到2025年,中国男装市场规模将达到6570亿元”;

也有人说“2015-2019年,中国男装行业利润总额呈逐年下降趋势”,放言“中国男装市场落后女装10年”。

那么,关于“号称6000亿元的男装市场究竟行不行”这件事,在2022年第三季度已然结束的当下,知衣科技将以刚出品的《2022Q3男装电商销售数据》报告结合男装上市公司财报与全球时尚行业前瞻,去伪存真,找到真正的答案。

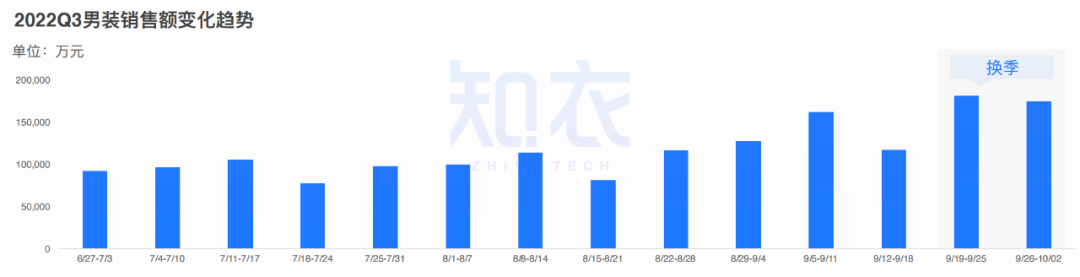

首先从最新的2022年第三季度男装电商市场大盘走势来看。

以周为单位,知衣科技观察到男装销售额在第三季度的最高值与最低值之间的差额在10亿元左右。受降温换季影响,男装销售额在进入9月之后呈微幅上升趋势,并在9⽉最后两周⾥,周销售额突破18亿元,达到了整个第三季度的峰值。

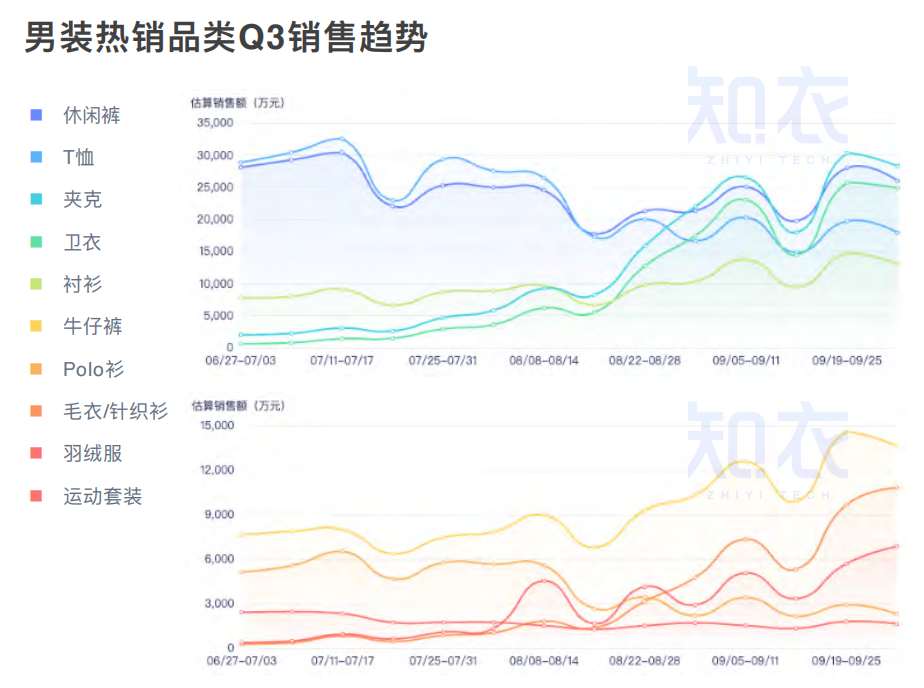

细化到各个男装品类的销售趋势,结合时间和季节性因素,可以得出:休闲裤和T恤品类在7⽉和8⽉初的销售情况最好,且销售额明显⾼于其他品类,但8⽉中旬之后有明显下降趋势。

夹克、卫⾐、⽜仔裤品类在8⽉中旬之后呈⼤幅度上升趋势,并在9/19-9/25期间达到各⾃的销售峰值;Polo衫在Q3期间呈逐渐下降趋势;运动套装的销售情况最平稳。

此外,知衣科技从各个男装品类的销售额占比注意到休闲裤与T恤是典型的高销下滑品类,即凭借较低单价在市场份额占比上占有绝对性优势,但同比却呈较大幅度下跌趋势。

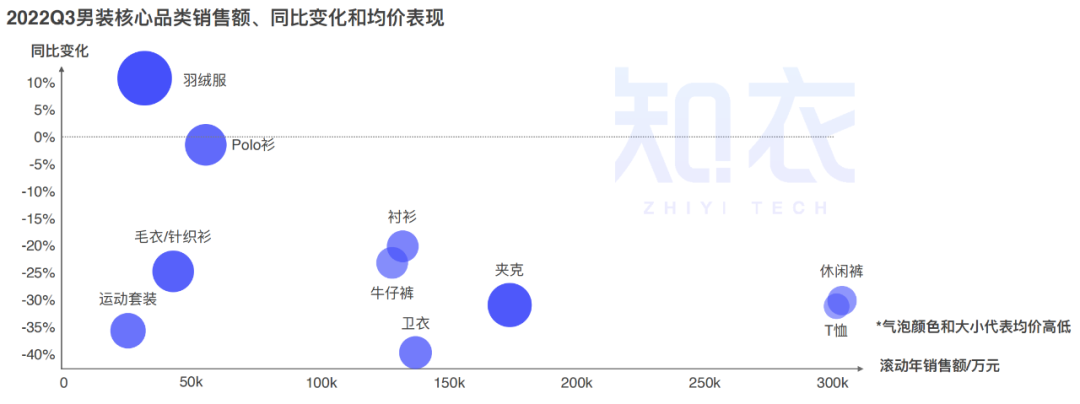

将每个品类的同比变化、年销售额、均价表现作图,能明显观察到,除了休闲裤与T恤同具有高销量下滑的特点之外,衬衫、牛仔裤、卫衣、夹克为中等销量下滑一类,运动套装与毛衣/针织衫为低销量下滑一类。

与之相反的是羽绒服与Polo衫品类,尤其是羽绒服,在气温引起的换季需求之外,其销量与销售额在服装市场整体下滑的趋势之下仍然呈现出同比上升的增速。

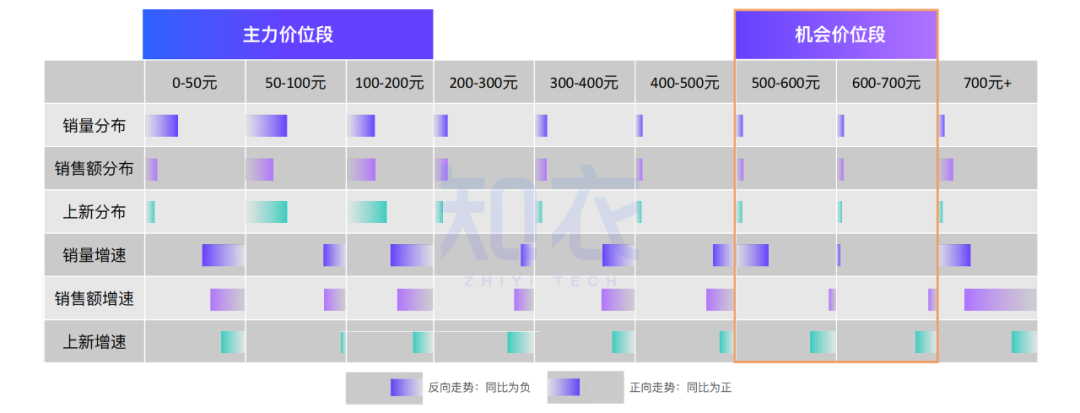

同时,知衣科技围绕价格段,对男装不同价位段的销售情况做分布和增速的同比分析,发现仅有500-700元价位段的销量增速呈现正趋势,表明这是一个充满机会的产品开发价位段。但以销售占比分布来看,却由0-200元价位段占据绝对市场份额。

用数据盘点完最新的第三季度男装电商市场表现之后,我们再来看看国内男装主要上市企业(包含海澜之家、利郎、九牧王、报喜鸟、杉杉公司等)对外公布的半年报,以聚焦更为具象的男装市场,探讨更清晰的男装行业现状。

综合财报所透露的信息,知衣科技所统计的男装上市公司中营收超10亿元占比75%,其中被称为“男人的衣柜”的海澜之家在连续三年内蝉联A股上市公司服装行业营收第一后,本次依然以95.16亿元遥遥领先其他企业。

相比营收,更值得注意的是同比,75%企业都有不同程度的下滑。

结合今年上半年国家统计局公布的全国社会消费品之服装、鞋帽、针纺织品类零售总额同比下降6.5%的市场趋势,2022年3-5月期间的疫情或是造成大面积同比下降的主要原因,江浙沪地区的“浙派”男装产业集群的大量实体门店无法正常营业、物流受限、产品延缓上新,对整个服装行业的上半年业绩造成了一定压力,并逐渐波及全国。

基于此,对比2021年同期财报所披露的成绩及展现出的涨势,不少行业内人士认为2022年疫情对消费行业的挑战甚至大于2020年。

考虑到大环境的不确定性,以及疫情之下行业优胜劣汰加速,马太效应凸显的市场竞争趋势,不少公司在财报中也提及优化运营和缩减门店等举措。

对外经济贸易大学教育与开放经济研究中心产业部主任卢福永认为:“中国男装行业目前进入相对平稳的增长期,行业总体市场规模可观。但全行业市场集中度较低,龙头企业市场占有率不高,我国主要的男装品牌集中在中端市场,由此导致了较为激烈的市场竞争,差异化发展不足。”

因此,也有不少企业欲冲破“男装同质化”的认知屏障,强化品牌区分度。比如红豆股份董事长戴敏君曾公开宣布,“2022年的红豆男装将锚定“舒适男装”新赛道,定位“经典舒适男装”,以新战略展现新姿态”。

而男装龙头企业海澜之家还在今年发布了传统生肖“虎虎生风”IP服饰系列,意在结合中国传统文化,为品牌找到一个更容易引起消费者共鸣的差异化竞争路线。

这些思路则与卢福永所强调的观点不谋而合。“在消费端,男装市场的功能性消费特征更为明确,职业正装和时尚休闲作为主要的两条产品线,也符合大部分男装企业的产品布局。男装市场消费者对产品的需求更加多元,促使男装品牌的产品和服务形成自己的差异化竞争优势,才能保持稳中有进的发展态势。”

需要注意的是,本土男装品牌之外,还有大量的国际品牌、运动品牌,以及新锐设计师品牌、潮牌等同在竞争行列中。

相比国内男装市场的不确定性,以欧美为代表的国际男装呈现出非常积极乐观的销售态势:

“男装业务的增长非常强劲,这是我职业生涯中见过的最强劲的增长趋势”——时尚买手集合店Mitchells Stores联合首席执行官Bob Mitchell

“目前我们还没有看到任何放缓的迹象,男装生意真的很好,虽然也可能会出现衰退,但我们也已经做好了准备。”——纽约男装集合店 Rothmans的总裁Ken Giddon

“公司男装业务的表现十分好。很长一段时间以来,我们一直处于休闲街头的男装潮流中,但现在男士们正在用精致的运动服、高级成衣和定制正装来更新他们的衣橱。”——梅西百货服装业务总经理Sam Archibald

“男装业务作为Machine-A的传统优势,在今年的销售表现十分良好,甚至已经超过了疫情前的水平。男装消费者目前出现了一股新趋势,即女性消费者也逐渐成为了男装品牌的主要受众。”——买手店Machine-A创始人兼采购总监Stavros Karelis

“男装业务在所有渠道中都表现良好。从目前Selfridges的销售数据来看,T恤和运动衫的销售情况非常亮眼。但同时正装、秀场款和经典品类整体增长也非常强劲。”——Selfridges男女装总监Bosse Myhr

……

结合IMARC的研究数据预测,“2021年全球男装市场的销售额为5333亿美元,全球男装市场预计在2022年-2027年的复合年增长率为5.92%,并将在2027年达到7469亿美元的销售额”,可见全球男装市场的巨大潜力尚未被完全开发,尽管与疫情有着较强的相关性。

显然,欧美地区的男性消费者随着疫情防控措施的陆续取消,线下办公室与日常社交场景恢复,男装的消费需求大幅反弹,并因此收获了爆炸式增长,与2021年的中国男装市场有一定程度的趋势吻合。

同时,根据欧美大多数的男装零售商的反馈,原先大受欢迎的运动休闲服在2022年有所放缓,男装正装成为销售增长最快的业务,且男性消费者用休闲运动+西装正装创造出了Athflow的混搭风格,进一步促进了西装与运动休闲系列服装的销售。

总的来看,由于疫情风险、行业大盘下滑、品牌区分度低、产品力不足等内外因,2022上半年的国内男装市场整体表现略有颓势,直至第三季度的9月男装销量回温,其中以高单价的羽绒服同比增速最为优秀,值得注意。

参考资料

1.《深度 | 尽管市场有逆风,但男装零售商们仍保持乐观》,WWD国际时尚特讯

2.《上半年国产男装品牌盘点:市场集中度正在上升》,每日财报网