一组数据看防晒衣凭什么1个月卖出11亿

2024-06-17

知衣科技

继开年“新中式”爆火,2024年第二个爆款服装品类在618榜单中闪亮登场——防晒衣。

在知衣科技公布的淘系618“年中开门红”首日的爆款TOP10榜单中,女装榜被“时尚防晒服”前10占7屠榜;童装中也被“儿童皮肤衣/防晒”拿下第1、第3与第6共3个位次。

实际上早在去年618,该品类就有大火迹象。彼时“时尚防晒服”品类的同比涨幅极其亮眼,不仅女装暴涨2595%,男装暴涨4332%,连童装行业都有着1824%的同比增长。

相较2023年618时数千的涨幅与潜力趋势,今年的防晒品类则呈现出一种“杀疯了”的白热化竞争态势。仅5月份,淘系电商女装行业“时尚防晒服”类目就卖出了11个亿的销售额,占2023年全年销售总额的23.9%,涨势凶猛。

那么,从2023年爆到2024年的防晒衣,市场规模有多大?行业增速如何?头部品牌有哪些?线上爆款有哪些特点?还有哪些产品机遇可被开发?

为回答上述问题,知衣科技将2022.1.1-2024.5.31的淘宝、天猫、抖音的女装、男装、童装、户外防晒衣销售数据为样本,对防晒衣市场展开深入分析和研究,以下是结论总览:

1. 基本盘:防晒衣近一年线上电商市场销售规模为63亿元,同比增长52%。天猫是核心渠道,市场占比最高达到75.4%。

2. 行业增速:抖音渠道的防晒衣市场份额增长显著,季节性特征显著。2024年3月的市场份额达到新高。

3. 品牌格局:天猫市场品牌集中度较高,以蕉下、小野和子等为代表的TOP5头部品牌销售额占据近半市场份额。

4. 评价分析:24年5月,淘系的防晒衣评论数超22W,其中户外行业的防晒衣差评率最高,达到了8.46%。

⭐️ 关注我们,每周都有服装行业干货分析~

从销售侧走势来看,大防晒衣电商市场(仅代表淘/天/抖音的女装、男装、童装与户外的头部行业趋势)呈现出鲜明的季节性特征,每到3月销售起量,直至6月迎来峰值。

截止2023年5月,防晒衣电商市场的销售额峰值出现在去年6月,达到了15.39亿元,销量为1434.5万件,平均价格为107元。今年防晒衣市场的销售峰值还未到。

再看近一年的电商市场容量,23年6月-24年5月期间,防晒衣在淘宝、天猫与抖音三大电商平台的销售总额达到了63亿元,同比增长52.51%。

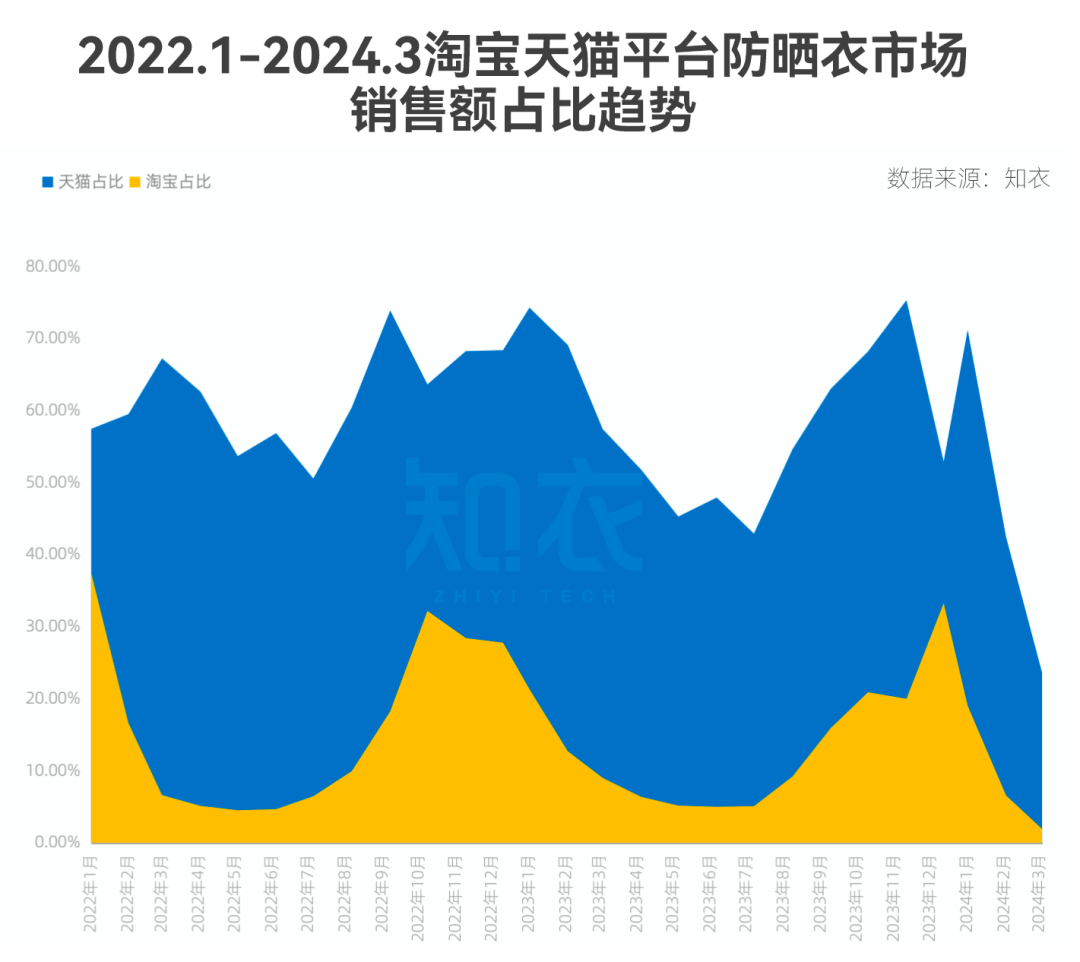

从防晒衣的线上渠道分布来看,天猫是市场核心平台,市场占比最高达到75.4%,大量防晒衣头部品牌都集中于天猫,如蕉下、蕉内、骆驼、觅橘等。

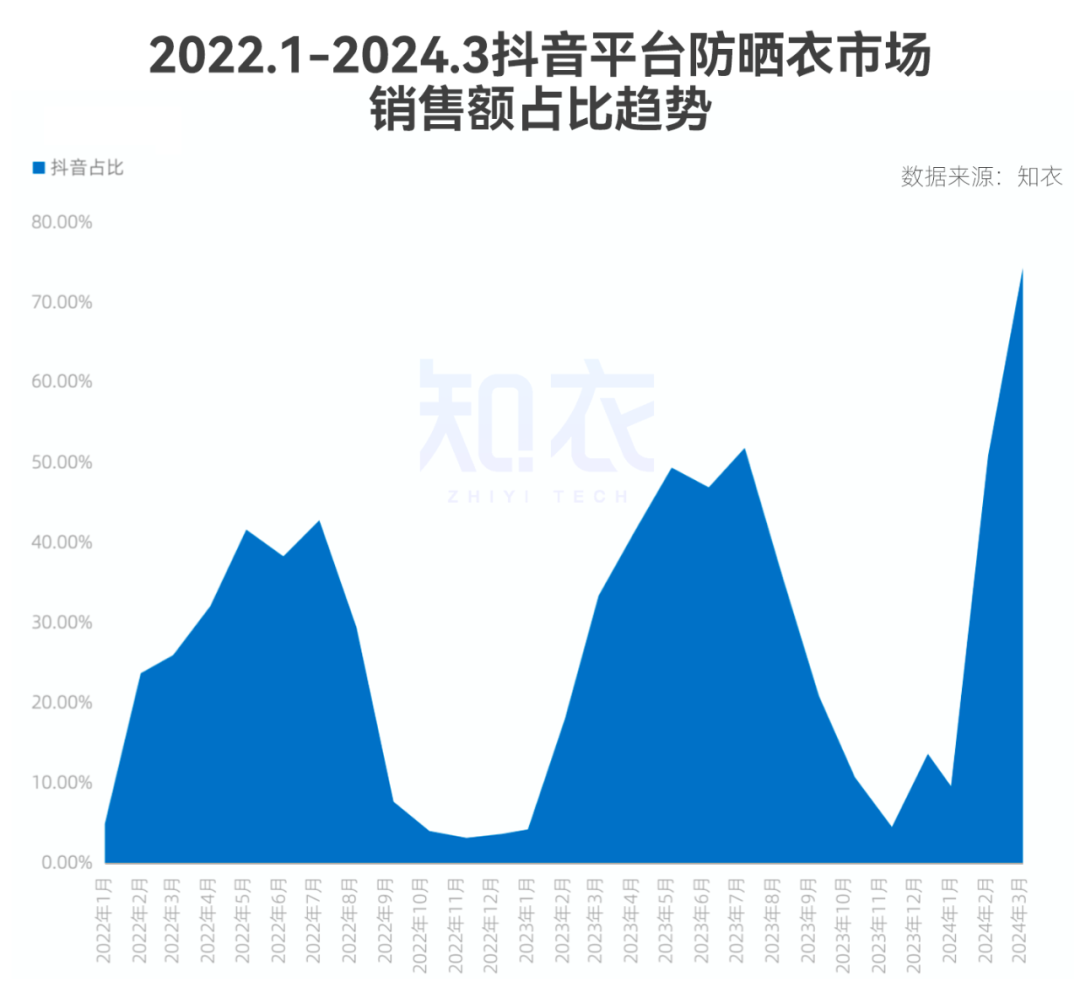

抖音平台的季节性更加明显,极差更大,最高值多在5-7月,最低值一般出现在每年11月。2024年3月以来,抖音渠道的增速迅猛,市场份额增长显著,占比一举超过70%。

总的来看,天猫的防晒衣销售额占比较为稳定,长期保持在42%~75%之间;抖音的渠道占比呈现出更“极端”的淡旺季特征,每到3月,即防晒衣市场开始爆发之时,抖音的渠道占比就会开始猛增,直至8月。

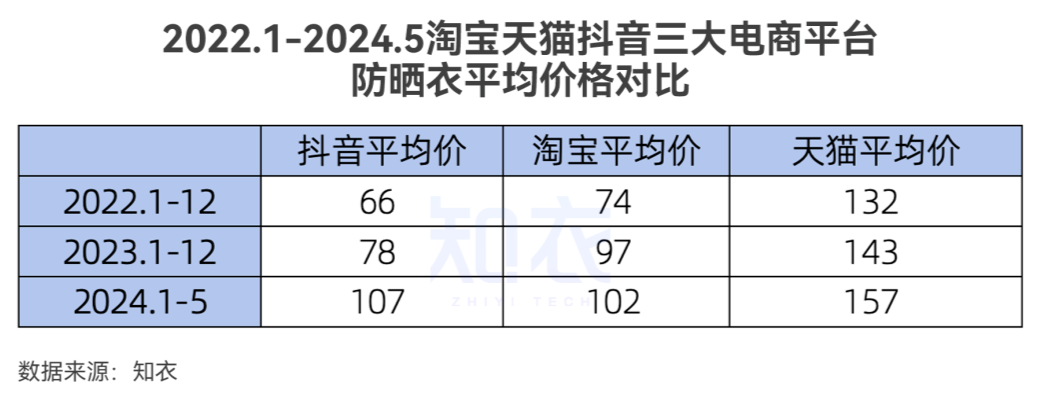

另外,对比三大平台近三年的防晒衣平均价格,均呈现出连年上涨的趋势。

天猫平台作为品牌旗舰店的官方阵地,每年的价格涨幅都在10%以内,体现了品牌控价的成果;而淘、抖的价格涨势则较为“野蛮”,具体表现在淘宝23年上涨了32%,抖音则在24年上涨了37.8%。

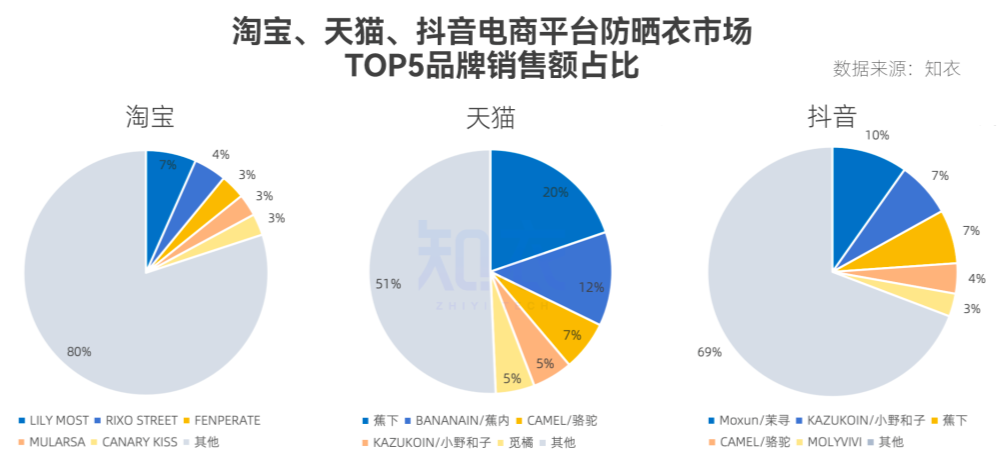

横向对比2022.1-2024.5期间淘宝、天猫、抖音的全服装行业(包含女装、男装、童装、户外)的防晒衣市场集中度,注意到天猫的TOP5头部品牌销售额占据了近半的市场份额。

而淘宝市场则较为分散,TOP5头部品牌仅占比20%,头部品牌尚未形成规模,说明市场入局门槛并不高,仍留有一定入局机会。抖音市场介于二者之间。

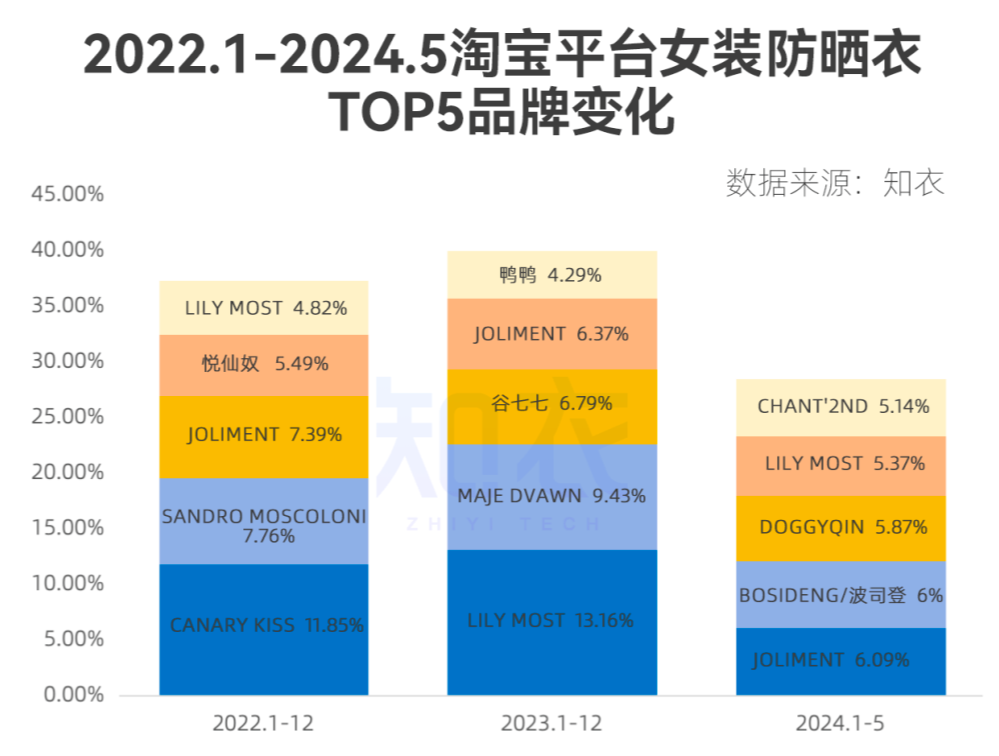

以女装行业下的防晒衣品类为分析对象,纵向对比淘宝平台每年销售额最高的TOP5头部品牌变化趋势,只有LILY MOST与JOLIMENT两品牌连续入选,TOP5头部品牌高频更替,淘宝市场竞争较为激烈。

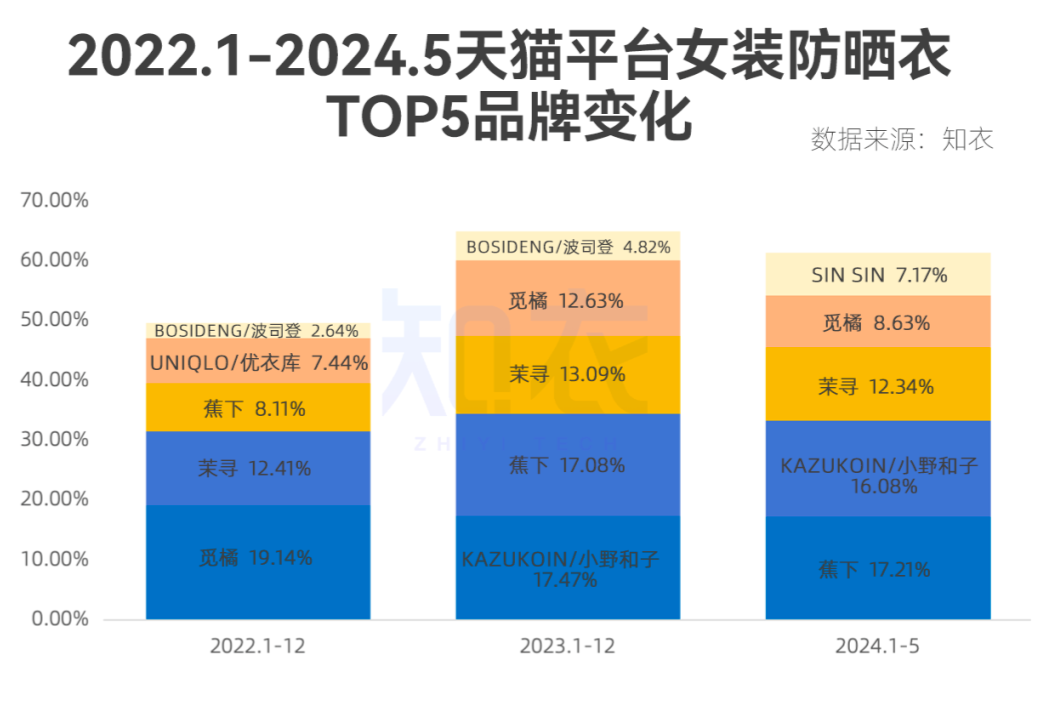

接下来看天猫市场的防晒衣品牌格局:以蕉下、小野和子、茉寻为代表的三大头部品牌格局稳定,且市场份额连续两年都保持在两位数以上。

值得注意的是,2024年后,SIN SIN品牌以7.17%的占比取代了波司登,成为第5名,波司登位居第6。

根据天猫市场的TOP5品牌变化趋势可知,22年觅橘品牌市场份额高达19%,23年小野和子凭借17%占比主导市场,到了24年变为蕉下。

整体看来,天猫消费者已经建立起较高的品牌认知,虽然市场第一名更替频繁,但多在几家头部之间,整体市场竞争难度较大。

商品标题

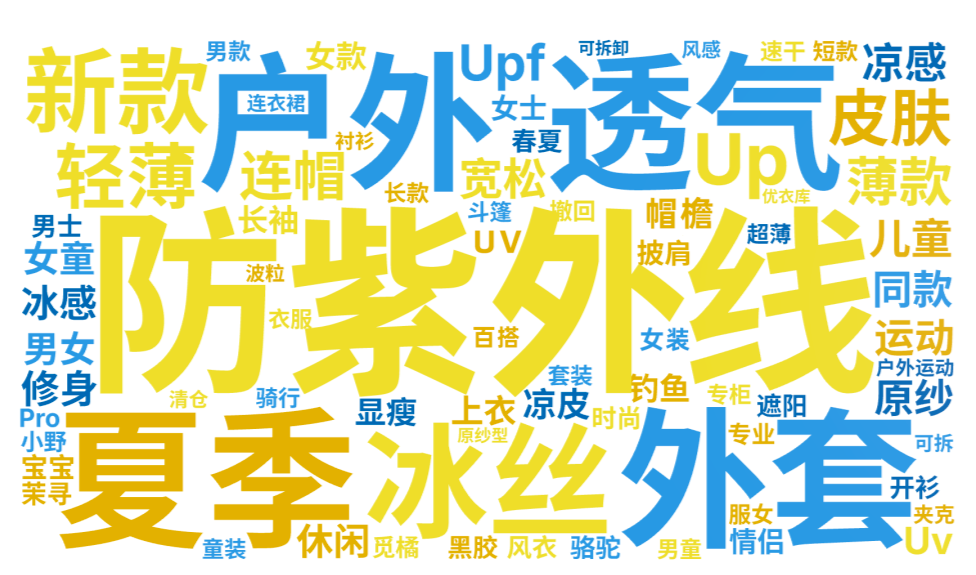

基于淘宝、天猫、抖音三大平台销售额最高的TOP500防晒衣商品,我们根据这1500件热销商品标题进行分词处理与词频统计,得出最高频出现的商品关键词,如下图所示:

“防紫外线”都是“防晒”之外提及率最高的词汇,出现率达到49.67%,其次是透气(41.8%)、外套(41.1%)、夏季(38.67%)、户外(30.8%)、冰丝(26%)、新款(20%)、轻薄(16.73%)、皮肤(16.53%)、UPF(13.27%)。

淘宝、天猫与抖音三大平台间的标题区分度较小,防紫外线、透气、夏季与外套均在前4。

评价分析

接下来,聚焦评价维度,我们来看看消费者对防晒衣的产品反馈:

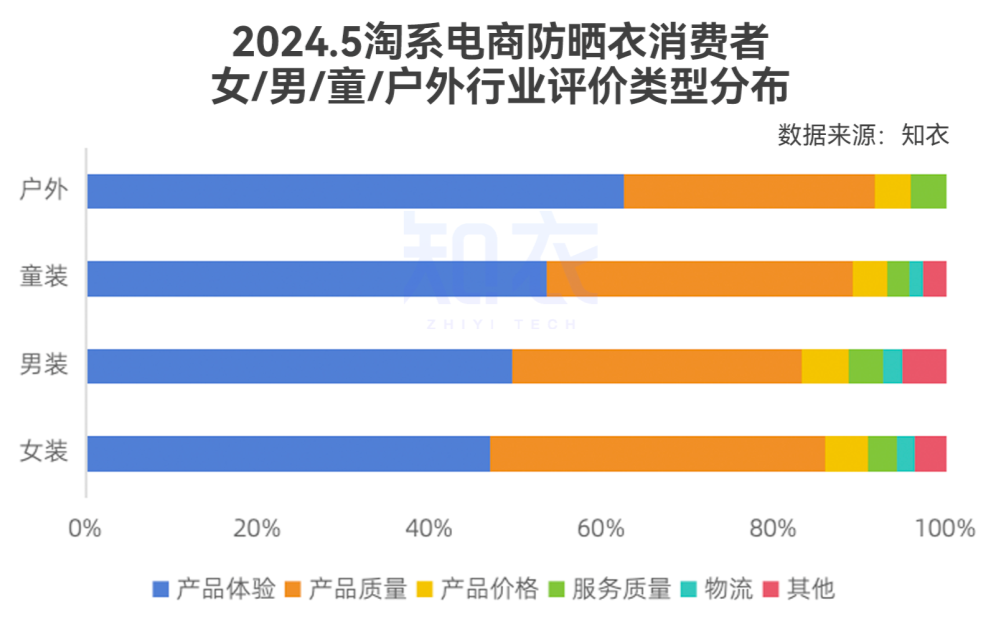

仅2024年5月,淘系(淘宝+天猫)平台防晒衣的评价总数超过了22W,其中户外行业对防晒衣的差评率最高,达到了8.46%。

每个行业的消费者反馈中,占比最高的都是产品体验,其次是产品质量。值得注意的是,户外行业的产品体验评价占比达到了62.5%,产品质量维度中女装行业的关注度最高。

从女装下的评论关键词提及率来看,防晒衣的显瘦、面料、透气是消费者最关注的三个重点。

“舒服”的相关提及率在前10占3,且面料、透气度的合适对防晒衣的舒适度也有一定的相关性,基于此,品牌可再次提高防晒衣的“舒服”,尤其是面料的体感与透气度,并在营销侧着重提及,以提高消费者的购买动机。

机会价位段&关键词

根据2024年第一季度的淘系防晒衣各行业的价格段数据分析,我们通过销售占比与同比涨幅筛选出了女装、男装与户外行业中防晒衣未来最有机会的价位段,及其对应的关键词如下:

数据来源:《2024春夏防晒服白皮书-多平台分析》

女装行业中以200-300元价位段最有商机,Q1销售占比21.56%,却同比涨幅9.54%,该价位段的防晒服关键词为:宽松休闲、冰钛科技、帽檐设计、冰皮。

数据来源:《2024春夏防晒服白皮书-多平台分析》

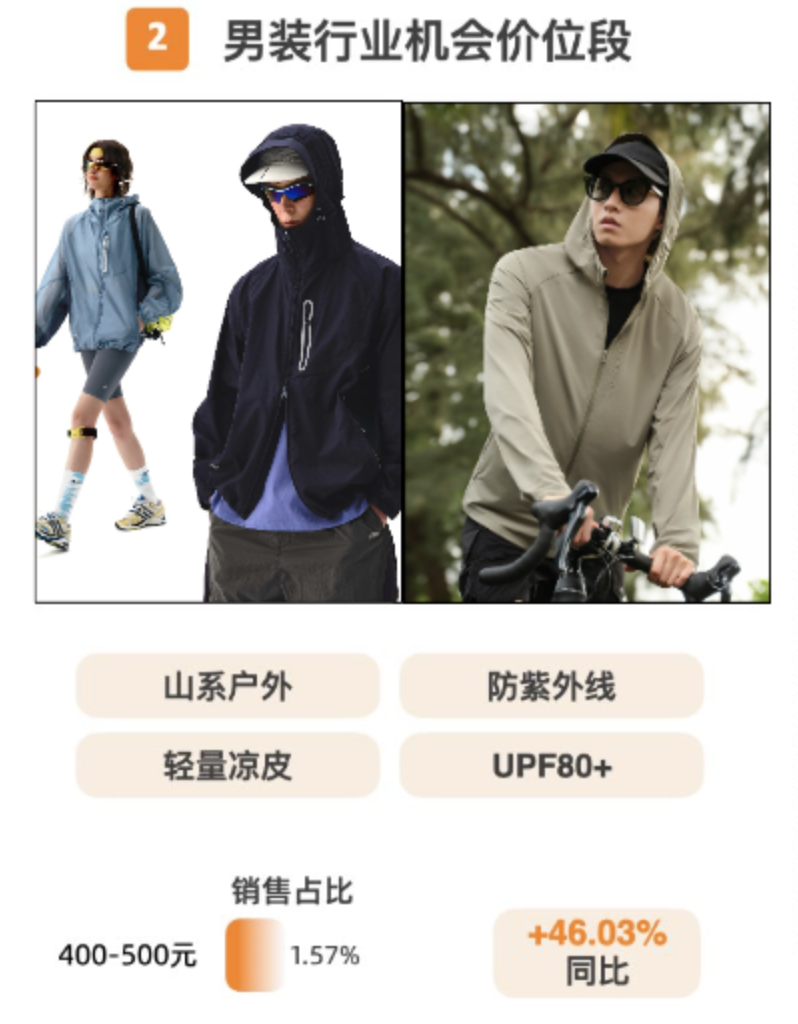

男装行业中的防晒衣机会价位段为400-500元,Q1涨幅达到了46.03%,关键词为山系户外、防紫外线、轻量凉皮、UPF80+。

数据来源:《2024春夏防晒服白皮书-多平台分析》

50-100元成为了户外行业防晒衣的机会价位段,销售占比达到了10.74%,关键词为情侣款、皮肤衣、户外运动、超薄透气。

数据来源:《2024春夏防晒服白皮书-多平台分析》

另一边的抖音平台,其防晒衣的主力价位段为50-200元,Q1销量占比最高的是100-200元,占比近30%;丰富产品开发的机会价位段则为300-400元。

将0~100元作为低价位段,对应的商品关键词为:透气遮阳、高倍数、冰丝原纱、黑胶大帽檐。

将100~300元作为中价位段,对应的商品关键词是户外冰丝、风感波粒、连帽升级款、长款披风。

300元以上是抖音防晒衣的中高价位段,户外运动、防风、科技面料、时尚高端是关键词。

得益于大众对预防皮肤衰老和光损伤意识的提升,“夏防晒”显然已成为“冬防寒”之后最火爆的刚需防护生意。

1.防晒应用场景增加:随着户外运动自2023年持续升温,消费者对防晒的应用场景增加,社媒讨论热度逐渐上升,如抖音与小红书上关于骑行、钓鱼、跑步、登上等场景的防晒讨论显著增长。

2.防晒需求多样化:加之持续走高的单价,消费者的决策因素发生变化,逐渐不再满足于防晒功能,而是追求更全面的防护,如抗紫外线、防风、防水、抗敏感、易收纳等功能,对防晒产品的科技性、功效性、品类拓展提出了更多样化的期待。

总的来说,2024年中国防晒衣市场呈现出快速增长的态势,同时也面临着产品多样化和标准化的挑战。如何在创新、专业化、舒适度与价格之间保持平衡,是防晒衣品牌接下来的发展重心。

以上就是本文针对“防晒衣”的数据分析,如果您想看更多服装相关的话题,欢迎评论区留言,我们也可以用数据来一起讨论~